Our The Modern Medicare Agency Ideas

Providers vary based upon an individual's degree as well as kind of need. Providers can be temporary, while recuperating from an injury or ailment, or long-term for numerous years, as well as can range from simple checks to extra thorough solutions. Solutions in your area might include dishes, transportation or aid managing chronic problems.

The 9-Minute Rule for The Modern Medicare Agency

Speed gives people a thorough solution that includes protection for healthcare and long-term solutions as well as supports. Medicare typically doesn't pay for long-term care. Medicare will certainly help pay for experienced nursing or house healthcare if you satisfy particular problems about a healthcare facility stay. Go to to learn more.

Long-term treatment insurance policy can assist pay for long-term care prices (https://usatoplistings.com/insurance-agency/the-modern-medicare-agency-melville-new-york/). Lasting care insurance policy might not be ideal for everyone. Check out the Oregon Insurance policy Division internet site for help deciding if long-lasting treatment insurance is appropriate for you. Oregon Job Independence is a program developed to aid people remain in their residences who do not get Medicaid long-term care solutions.

Not known Factual Statements About The Modern Medicare Agency

Those who fulfill solution qualification standards will certainly have access to: APD long-term solutions and also sustains which consist of aid with tasks of day-to-day living, such as movement, eating, toileting as well as supports pertaining to cognitive concerns - Medicare Part D. Oregon Health and wellness Plan advantages will not be considered Public Charge determinations, yet there is an exception for people obtaining long-term treatment in nursing facilities or mental health establishments.

There are several programs that might provide help, each with various eligibility requirements. Solutions can be given in an individual's house or in a treatment setting.

The Modern Medicare Agency Can Be Fun For Everyone

Recognizing the basics of Medicare as well as just how it functions will certainly help lay the structure you need to make choices concerning your Medicare coverage choices. This write-up explains Medicare Part A (health center insurance coverage). Medicare Component A belongs to Original Medicare (together with Part B), the government-sponsored health insurance coverage program for those who certify by age, impairment, or specific wellness problems.

Most of those that qualify for Medicare are instantly enrolled in the program. For additional information about qualification, see Medicare Qualification. Most individuals do not need to pay a premium for Medicare Component A. If you or your spouse operated at the very least ten years (40 quarters) and paid Medicare taxes while functioning, you'll obtain premium-free Component A.

What Does The Modern Medicare Agency Do?

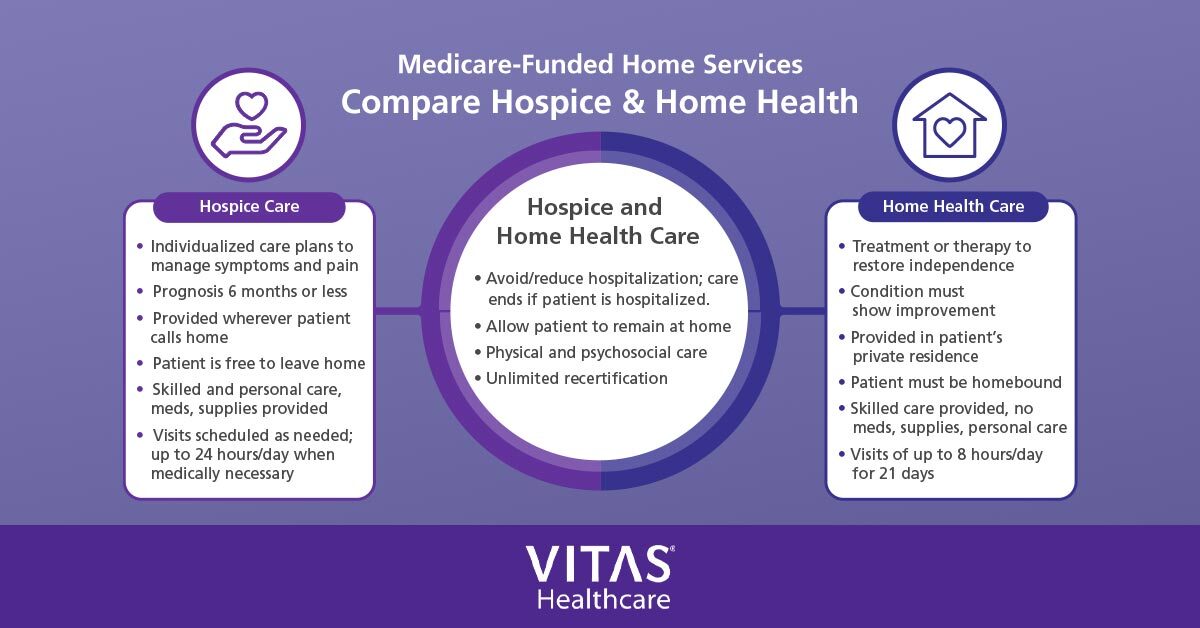

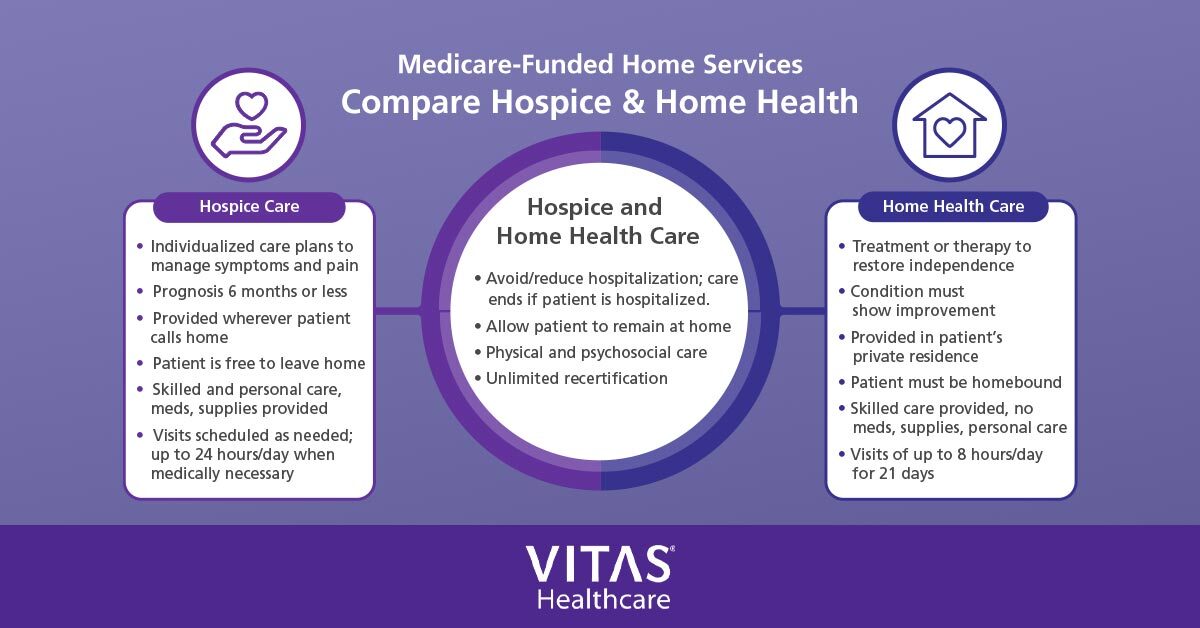

Medicare Component A is healthcare facility insurance policy offered by Medicare through the Centers for Medicare & Medicaid Solutions - Medicare Agent Plainview NY. Part A protection consists of (yet may not be restricted to) inpatient care in health centers, taking care of homes, proficient nursing centers, as well as vital gain access to health centers. Component A does not consist of lasting or custodial treatment. If you satisfy particular needs, then you may likewise be qualified for hospice or restricted house health care.

The 9-Second Trick For The Modern Medicare Agency

You do not require to file Medicare Part A claims as a beneficiary. Medicare Component A is mainly medical facility insurance. For insurance coverage of physician gos to as well as clinical solutions and also supplies, see Medicare Part B. Component A helps cover the solutions noted below when clinically needed as well as supplied by a Medicare-assigned health-care company in a Medicare-approved center.

The hospital gets blood from a blood financial institution at no charge, so if you receive blood as part of your inpatient keep you will not have to pay for it or change it - https://a1businesslist.com/insurance-agency/the-modern-medicare-agency-melville-new-york/. If the facility has to purchase blood for you, generally you require to spend for the initial three units you get in a fiscal year or have it given away.

The Modern Medicare Agency - Truths

Medicare Part A generally covers healthcare facility stays, consisting of a semi-private area, dishes, basic nursing, as well as particular health center solutions and also materials. Part A may cover inpatient treatment in: Essential accessibility health centers Inpatient rehab centers Severe care health centers Certifying clinical study studies Lasting care hospitals Psychological healthcare facilities (as much as a 190-day life time maximum) Medicare Component A covers this care if all of the adhering to are true: A doctor orders clinically necessary inpatient treatment of at the very least 2 evenings (counted as midnights) - Medicare Advantage Agent.

You require care that can only be given up a healthcare facility. The health center's Use Testimonial Committee accepts your keep. Medicare Component A covers restricted treatment in a proficient nursing center (SNF) if your circumstance fulfills a variety of criteria: You've had a "qualifying inpatient hospital remain" of at the very least three days (72 hrs).

The Best Strategy To Use For The Modern Medicare Agency

The SNF is Medicare-certified. Your physician has actually determined more helpful hints you need competent nursing care daily. This care must originate from (or be straight supervised by) experienced nursing or therapy team. You have not utilized all the days in your benefit period. (According to Medicare, this duration begins the day you're confessed to an SNF or a healthcare facility as an inpatient, and also finishes when you have not had inpatient care or knowledgeable nursing look after 60 consecutive days.) You require competent nursing services either for a hospital-related medical condition, or a health and wellness condition that started when you were obtaining SNF take care of a hospital-related clinical condition.

Expect your health center remain was for a stroke and also your doctor determined that a nursing house or skilled nursing facility was medically necessary for your recuperation. In that situation, Medicare might cover a nursing home or experienced nursing facility remain for rehabilitation. An assisted living facility or knowledgeable nursing center keep consists of a semi-private area, meals, as well as rehabilitative and competent nursing solutions and care.

An Unbiased View of The Modern Medicare Agency

The very first 20 days are paid completely, as well as the staying 80 days will require a copayment. Medicare Part A will certainly not cover lasting treatment, non-skilled, everyday living, or custodial tasks. Certain healthcare facilities as well as vital gain access to medical facilities have contracts with the Division of Wellness & Person Services that allows the healthcare facility "swing" its beds right into (and also out of) SNF care as required.